irs child tax credit 2021

The Michigan mother of three including a son with autism used the money to pay. The payment for children.

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash Wbff

I have lots of kids so my child tax credits exceed my total tax by over 1400.

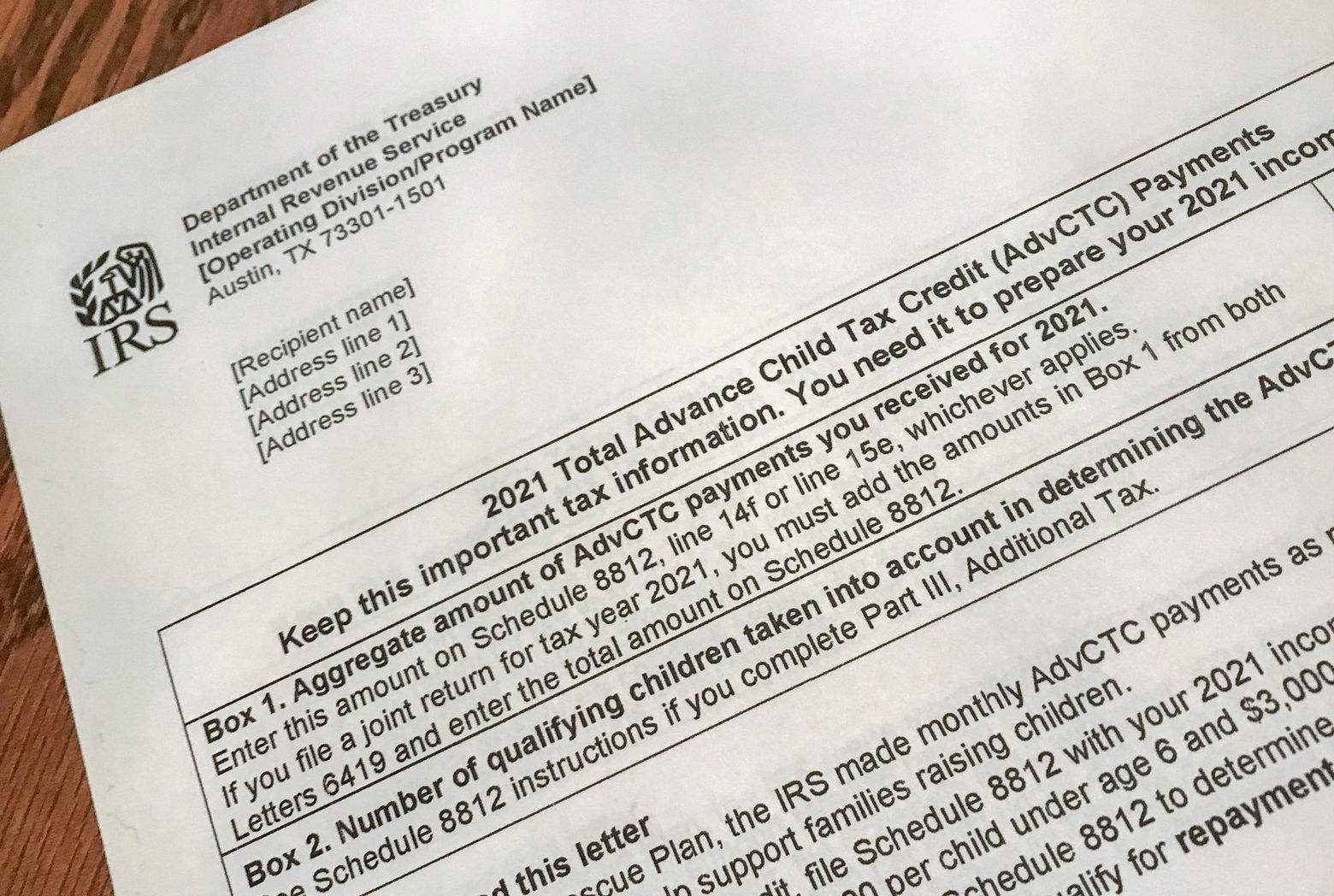

. Jan 24 2022 To help taxpayers reconcile and receive 2021 CTC the IRS is sending Letter 6419 Advance Child Tax Credit Reconciliation from late December. To help Puerto Ricans on this and other issues the IRS announced the Taxpayer Assistance Center in Guaynabo will be open and offering face-to-face help on Saturday May 14. Child Tax Credit 2022 refundable.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Single taxpayers with incomes under. Businesses and Self Employed.

The Child Tax Credit Update Portal is no longer available. These changes reflect that Publication 972 Child Tax Credit has become obsolete. For two or more children the amount has jumped from 6000 to 16000.

Under the American Rescue Plan Act ARPA of 2021 allowable expenses have increased from 3000 to 8000 for one child. The remainder will come when parents file their 2021 tax returns next. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

Schedule 8812 Form 1040 is now used to calculate child tax credits and to report advance child tax credit payments received in 2021 and to figure any additional tax owed if excess advance child tax credit payments. I tried googling this and every result is about 2021 or is ambiguous about the answer to this question. Check out the listed dates in the IRS tax refund direct deposit and mailed check schedule chart below to find out.

21 hours agoA smaller-than-expected refund or owing money can be Jun 22 2021 The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The monthly payments are advances on 50 of the CTC that you can claim on your 2021 tax returns when you file your taxes in early 2022. 150000 for a person who is married and filing a joint return. The guidance provides simplified procedures to allow eligible Puerto Rico CTC filers defined below who were not required to file a 2021 federal income tax return to provide information to the IRS to claim the CTC by filing a.

7 Jan 1 2022 Complete Schedule 8812 Form 1040 Credits for. The American Rescue Plan Act of 2021 was enacted on March 11 2021 making the Child and Dependent Care credit substantially more generous and potentially refundable up to 4000 for one qualifying person and 8000 for two or more qualifying persons only for the tax year 2021 This means. 112500 for a family with a single parent also called Head of Household.

For the tax year 2022 is the child tax credit refundable up to 1400 per family or per child. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income.

Earned Income Tax Credit. Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments. Ad The new advance Child Tax Credit is based on your previously filed tax return.

The child and dependent care tax credit helps working parents afford the cost of childcare. The Child Tax Credit is up to 3600 for those 5 and younger or 3000 for those up to age 17 by the end of 2021. 3600 for children ages 5 and under at the end of 2021.

The advance is 50 of your child tax credit with the rest claimed on next years return. 8 million refunds to Americans who paid too much tax on their unemployment. Those who are eligible for the increased credit amount include.

The IRS on Friday provided guidance on how bona fide residents of Puerto Rico can claim the child tax credit CTC for tax year 2021. Is the Child Tax Credit for 2020 or 2021. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

How much is the child tax credit worth. Additionally the reimbursement percentage for employment. Your amount changes based on the age of your children.

CNN Eligible parents will begin receiving the first monthly installment of the new enhanced child tax credit starting on July 15. 21 hours agoThose who did not make the cut Master File transcripts will continue to update as usual with msg on the WMR changing or Jul 08 2021 Expanded child tax credit starts next month 0528. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

The 500 nonrefundable Credit for Other Dependents amount has not changed. If you opt out of advance payments you are choosing to receive your full Child Tax Credit 3600 per child under age 6 and 3000 per child age 6 to 17 when you file your 2021 tax return which you file in 2022. The 2021 Earned Income Tax Credit provides a tax break for low-income workers and families based on their wages salaries tips and other pay as well as earnings from self-employment.

3000 for children ages 6 through 17 at the end of 2021. Updated 603 PM ET Mon July 12 2021. The IRS distributed half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child.

The IRS will send Letter 6419 in January of 2022 to provide the total amount of advance Child Tax Credit payments that were received in 2021. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. The American Rescue Plan temporarily increases the child tax credit for the 2021 tax year.

The IRS urges taxpayers receiving these letters to make sure they hold onto them to assist them in preparing their 2021 federal tax returns in 2022. Taxpayers should refer to Schedule 8812 Form 1040.

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

How The New Expanded Federal Child Tax Credit Will Work

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wkrc

2021 Child Tax Credit Advanced Payment Option Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Advance Monthly Payments Explained Donovan

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Child Tax Credit 2021 Changes Grass Roots Taxes

2021 Advanced Child Tax Credit What It Means For Your Family

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com